Queensland is a Shining Light for Post Mining Slump in State’s Economy

Despite the downturn in Queensland’s economy due to the post-coal-boom hangover, the property market is still showing promise to lead an economic revival for the state. The residential property boom in the capital city, Brisbane, has coincided well with the end of the coal boom to ease some of the economic burden on the state.

The Crane Count – Brisbane’s unofficial guide to economic health – shows that the city is still amidst a construction boom with 104 cranes visible across the skyline. This falls only slightly behind Melbourne with 148 cranes, and Sydney with 288 cranes.

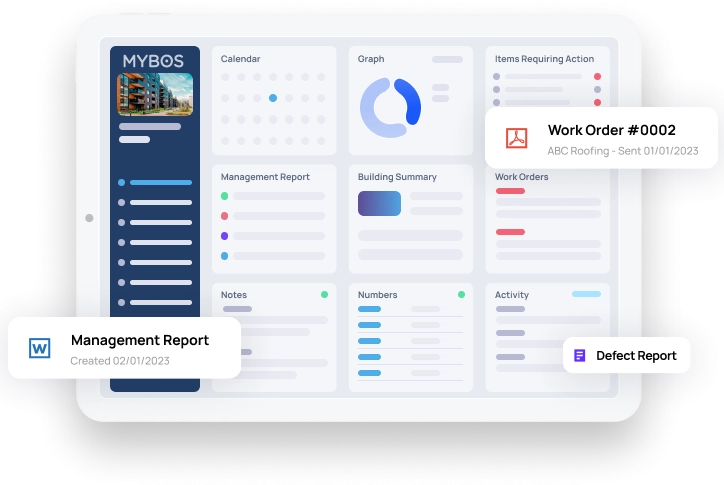

For those driving this growth, software for building developers can streamline project management and ensure better coordination across multiple sites. Given population figures in these cities, these numbers are heartening and show that Queensland property is a shining light after post mining slumps in the state economy.

While property prices in Melbourne and Sydney have recently been struck by downturns, Brisbane has remained much more stable, and in some cases, is still on the rise. Increased wariness around other capital cities has led to many media reports declaring South East Queensland as the new investment hotspot. This is music to the ears of the Queensland State Government, as they continue to look at ways to improve the economic situation across the state.

Recently, figures from CoreLogic’s Hedonic Home Value Index report indicated that Brisbane was the only capital city to show a growth in building prices, with a price rise around 4 percent. In line with this increased interest in Brisbane property, State Government projections have accounted for a population that is expected to hit 6.7 million by 2036. In turn, the Government is committed to increased spending on vital infrastructure.

When compared to Sydney and Melbourne, Brisbane is still much more affordable, and this appeal to budget means that the Queensland market is much less exposed to tightened lending criteria and further changes from the Royal Commission. All this has dubbed Queensland as a ‘landlord market’ and more and more building owners are looking for ways to include Queensland property in their portfolios.

At times, it can be hard to keep on top of market trends and collect the right data to make informed property decisions. A great way to track property data is via property building and management software like MYBOS, which even has an app that you can use on your mobile phone or tablet.

Don’t miss the boat. Start considering Queensland property now while the state is still recovering from the post mining slump, and prices are right.