Reflecting on a turbulent year for property development

2018 has come to an end, and it’s a good time to reflect on what has occurred in the past 12 months, and what this means for 2019 property development.

Cautious markets

The headline for 2018 was a major change in housing prices nationwide, with eastern capitals seeing significant drops in prices. Buyers exercised caution when it came to financing, and were more selective about their purchases.

The reasons behind this slowdown relate to the tightening of lending criteria, increased supply (notably for apartments), and a decrease in overseas demand. As buyers became more strategic in their purchases, the property broom suffered a sharp reversal.

Tightening of lending

The tightening of lending has perhaps been the biggest contributor to restrictions on property. Banks were less likely to lend based on higher risk, limited by a 30 per cent limit on interest-only residential mortgage lending. Although introduced as a way of balancing sound practices in lending, the cap inevitably limited potential for competition. It has put more pressure on those with limited or reduced access to finance, inevitably favouring those with more expendable capital and assets.

However, there is good news on the horizon. The banking regulator is set to remove its cap on interest-only residential mortgage lending, giving more choice for financing in 2019. Although a recent development (reflecting some caution), this helps loosen some of the restrictions on property development for the coming year.

Think about the long view

As 2019 gets going, there’s likely to be the continuation of cautious lending and investment. This doesn’t mean that opportunities won’t present themselves, but certainly financing will want to take a long-term view to property. Be mindful of strategic needs and making prudent decisions over finance. There will still be ways for developers to grow over the next 12 months.

What to consider for 2019

It will be prudent to keep a careful eye on new progress in the sector. While some risk has been identified, there is some cautious optimism about a ‘soft landing’ in response to economic fluctuations.

Remember to keep networking. A sound approach in general, maintaining contacts helps identify new opportunities, while being able to monitor for riskier times ahead.

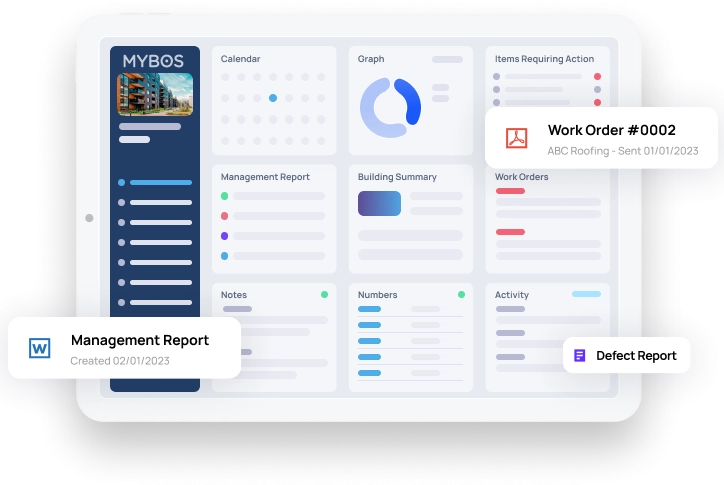

Finally, don’t get caught out with day-to-day issues. Strategic thinking requires sound planning and organisation, so make sure to keep on top of effective business management. Investing in reliable building management systems, like MYBOS, for example, can help minimise bureaucratic distractions.